Demystifying Tax

Tax can be daunting but it doesn’t have to be.

Understanding which taxes apply to you and how to submit them can be daunting, but it doesn’t have to be.

Make Your Company Tax Efficient Today

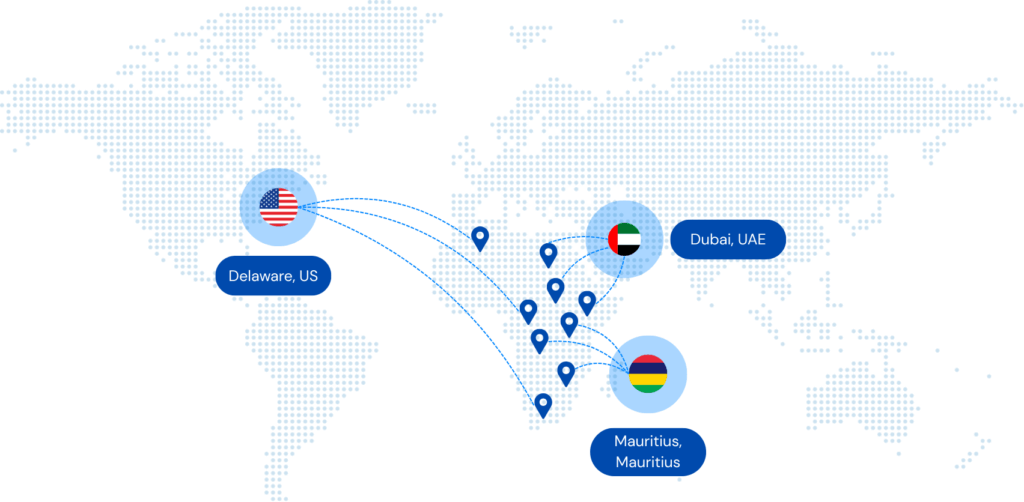

Delaware, US

Mauritius, Mauritius

Dubai, UAE

Are you a multi-entity business trying to figure out how to make your company more tax efficient?

Or are you a startup trying to decide where you should be headquartered for tax purposes?

Prochange offers clients with a one stop tax and compliance solution to all your global tax needs. Our tax experts across the African continent, US, Mauritius, and the UAE are experienced in working with multiple entities to ensure tax efficiency globally and compliance locally.

If you’re finding yourself wondering how to make your startup more tax efficient, look no further.

Let Prochange’s expert tax consultants guide you.

Our consultants have knowledge about Africa-wide tax regimes and protocols, as well as the UAE Free Zones, Delaware, and Mauritius

Let ProChange handle all your taxes while you focus on growth and revenue.

Work with our experts to understand how to manage your tax liabilities and avoid tax penalties.